Tesla February 2025

The astrology of Tesla stock price in February 2025

With Musk spending all his time “auditing” or DOGE ( I use the term widely as it doesn’t sound like any auditing I’ve even seen), he’s neglecting his other babies a little. Although that might be a good thing as his association with Tesla doesn’t seem to be enhancing its prospects.

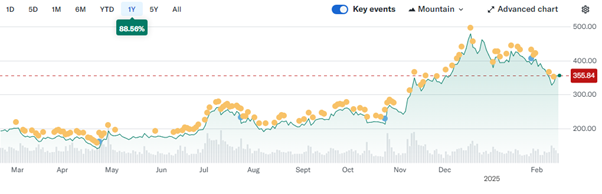

The stock has fallen from a high on December 17th and continued to fall until last week, its dire sales in Europe haven’t helped.

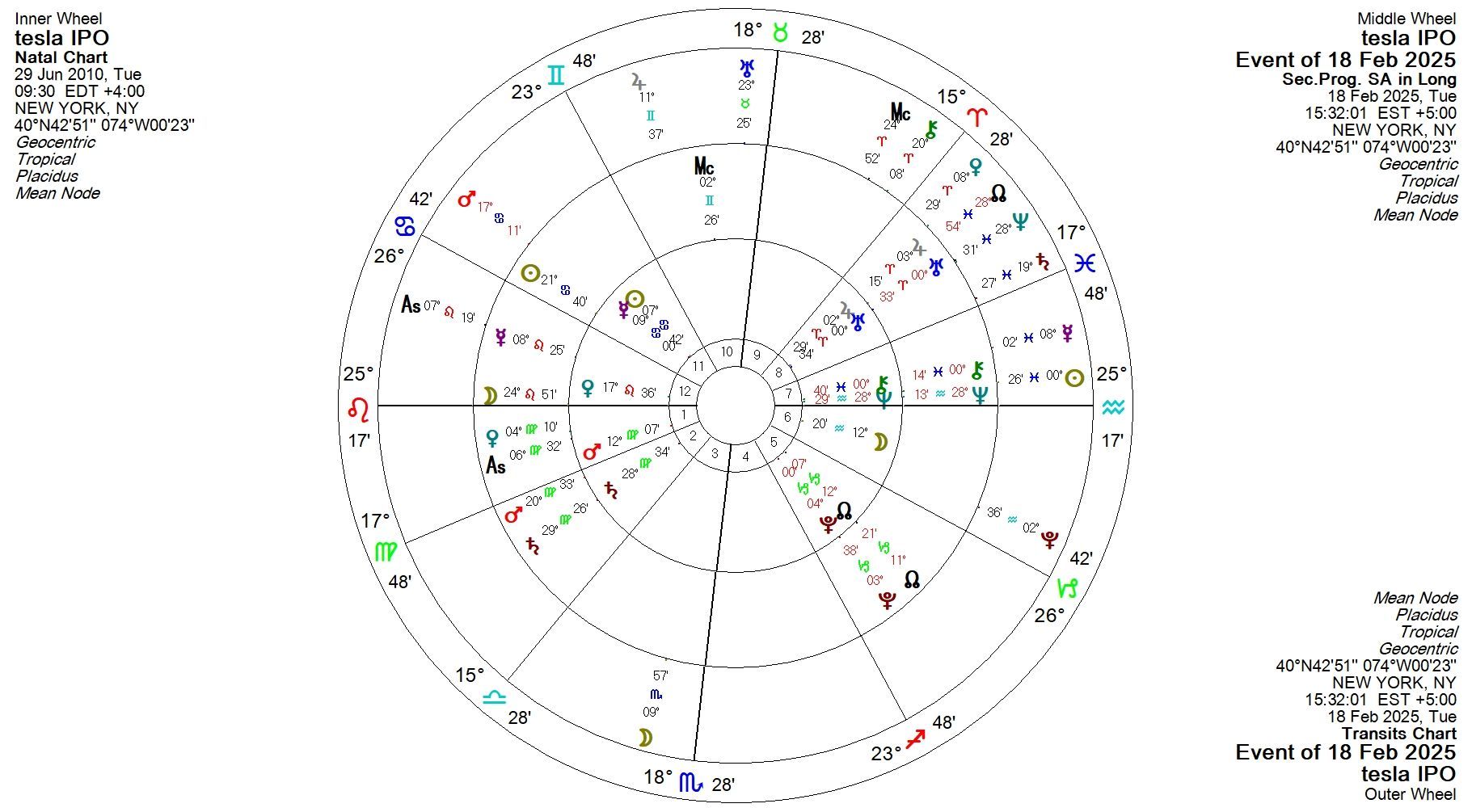

What is happening in the chart?

We can see there are some contrary factors. Pluto sextile Uranus and Jupiter is probably responsible for the longer term growth – the Uranus aspect was almost exact around 17th December. Pluto is also trine the progressed MC, which can bring major gains but also when combined with other factors significant reversals too. That is particularly the case since the progressed MC is quincunx natal Pluto and applying. Challenges are to come.

Neptune opposing Saturn is the next aspect for our consideration. It is usually negative, creating inertia, caution and delays. It has been in place for the last couple of months and is probably a big contender for the ongoing downturn in stock price.

Neptune will now go on to conjoin Uranus and Jupiter- which given it will also square natal Pluto is liable to pull things down into the mud further – though with more volatility than we have seen recently. Note big price movements are baked into this IPO chart.

Transiting Uranus is square the Ascendant axis, Uranus brings shocks and disruption, the fact that the progressed Moon is now close to the Ascendant doesn’t help- it makes shocks and drama all the more visible. Expect more in the coming weeks.

Saturn opposite the progressed Mars is also impacting trading levels, though somewhat mitigated by the progressed Sun in a trine position. This, ay last should reduce in affect, Though the coming conjunction between Neptune and Saturn suggests any such respite might be temporary.

Is this the worst chart I’ve seen? Not by a long shot, we are after all not that far from the high of December and still above the October 2024 levels- for the moment there is plenty to keep it from falling back to early 2024 levels leave alone pre 2021, for the immediate future but that doesn’t mean we'd want to be buying it either.