Bank of America 2023 and beyond

The astrology of Bank of America in 2023 and beyond

Prompted by the following report, that accompanied the results of the FED stress tests on June 28th, I thought my next analysis should be of Bank of America Corporation ( BAC)

Bank of America is bearing the cost of decisions made three years ago to pump the majority of $670bn in pandemic-era deposit inflows into debt markets at a time when bonds traded at historically high prices and low yields. The moves left BofA, the second-largest US bank by assets, with more than $100bn in paper losses at the end of the first quarter, according to data from the Federal Deposit Insurance Corporation. The sum far exceeds unrealised bond market losses reported by its largest peers.

However, there is a problem. The usual problem ; what chart to use, but this time magnified.

Oh, there is some great historical data: The early Bank of America called then Bank of Italy has a foundation date : 17 Oct 1904 in SF

There is even a date for the Federal charter 1 March 1927

The problem is that the original BAC does not exist. It ceased to do so on 1 Oct 1998(*) when it merged into Nations Bank, which itself had merged into NCNB in 1991. The final entity merely took the BOA name

All these banks had had multiple smaller mergers as well.

NCNB started life as First National Bank of Eastern North Carolina on 10 April 1952

The problem is that I can’t find a definitive first trade for the merger predecessors. Yahoo show data back to 21 Feb 1973, but elsewhere a date of 28 June 1976 is mentioned.

That’s frustrating. The data is out there but not easily available without physical library access.

Even this is confusing as BAC website state the merger was 27 July 1999, even though it was reported in the press in 1998 and even in the BAC 1998 annual report.

Worse the SEC filing states :On September 25, 1998, BankAmerica Corporation (the Corporation) reincorporated in Delaware and on September 30, 1998, NationsBank Corporation (NationsBank) completed its merger with the former BankAmerica Corporation (BankAmerica) and changed its name to "BankAmerica Corporation".

This seems to reconcile those dates and is the best we can get:

The Current Report on Form 8-K, dated September 25, 1998 and filed with the Securities and Exchange Commission on September 28, 1998 is amended to provide that the Registrant's Common Stock will begin trading on October 1, 1998 under the symbol "BAC."

So technically the new company was probably formed at the end of the day of 30 September and NYSE trading under the new banner was the following day.

It is a pity that earlier charts are so confused, but we’ll stick with the 1998 ones.

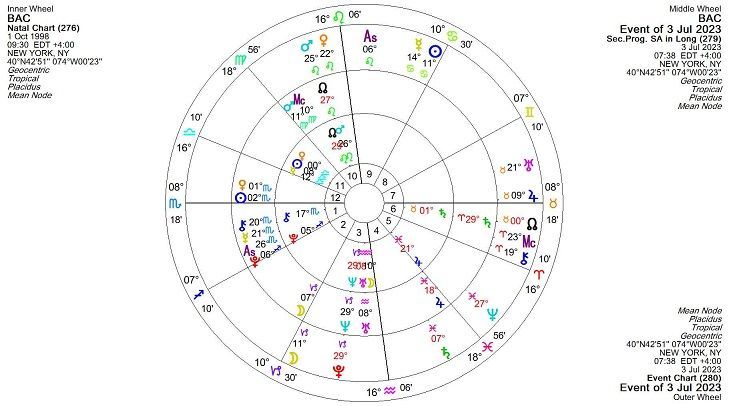

Here is the chart for the full moon on Monday 3rd July.

Obviously the first thing we see is Pluto conjunct the BAC Neptune )which is sextile the progressed Ascendant) and square the progressed BAC Saturn. No surprises with this combination that we are dealing with significant losses from financial instruments. We can also see Jupiter on the Descendant as the FED bringing the size of these losses to light.

Although the response for BAC is to say that the losses are unrealised, they are well capitalised and investors don’t need to worry, I would say they are not out of the woods yet. Neptune in sextile and trine to these positions is skimming over some of the reality.

Pluto will continue to transit this point for another year or two and also to square the natal Saturn. Not till 2026 is this something that can be ignored. And by then Uranus is opposing the BAC Pluto so upheaval is extremely likely – maybe they are forced to split or sell off certain activity.

Because, unfortunately, just as Pluto moves away from Saturn etc , It will Square the BAC progressed Sun – Venus conjunction and be sextile its own natal position – doubling its impact. That is liable to lead to leadership departures, operational deficits and all in all a poor picture.

Neptune will also eventually ( early 2026) move into Aries ( conjoining Saturn as it does so). It will then be opposite the BAC Venus, indicator of core values and is therefore likely to lead to a lack of connection between the company value and that of the underlying business.

By the time Pluto is at 8 degrees in early 2028 and given that this is square the Ascendant, I seriously doubt that BAC will be recognisable in its current form. A whole new ball game is started by January 2029.

What about next year’s Uranus-Jupiter conjunction, though?

Actually BAC is not so significantly impacted by that conjunction. It is opposite the BAC progressed Mercury but it is also sextile the natal Jupiter. For BAC, spring 2024 may be a time of opportunity and significant trade.

This is further confirmed by the conjunction of progressed Mars and the progressed MC at the same time. Mars is always concerned with trade. We can expect one of two things- either BAC will get a change to make some significant trades itself or someone may be make an offer for its activities. Possibly both will happen.

However, either way I see the company being mired in more financial difficulties in the 2-4 years that follow.

I should add that although this is rather negative we aren't in a BBBY or Evergrande situation here.